ohio unemployment income tax refund

Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest.

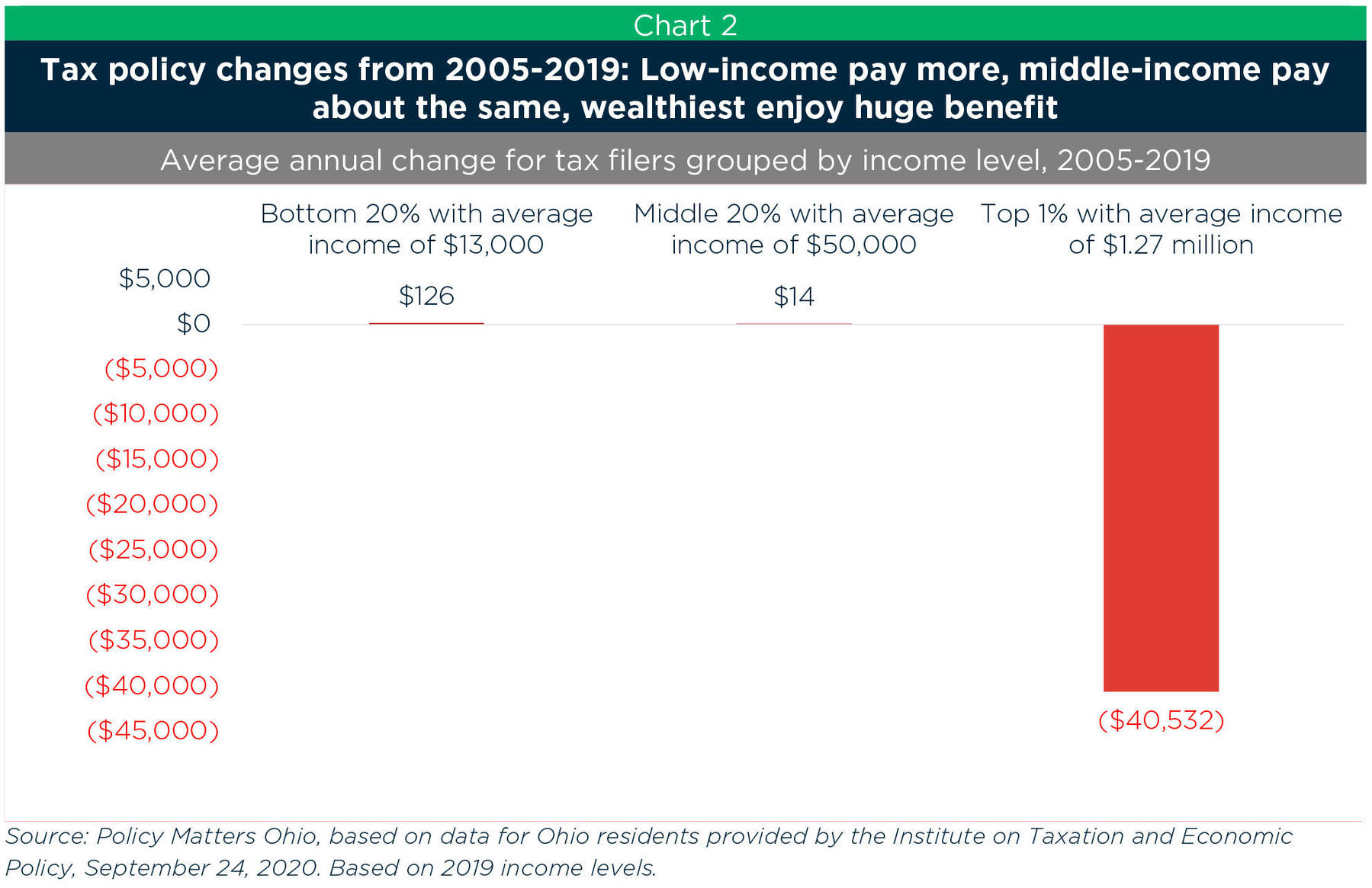

Rebalance The Income Tax To Build A Better Ohio For Everyone

The amount of tax will depend on your tax bracket.

. The Ohio Department of Taxation provides a tool that allows you to check the status of your income tax refund online. Unemployment compensation is taxable on your federal return. File for benefits online or by phone 247 including expanded benefits for those impacted by COVID-19.

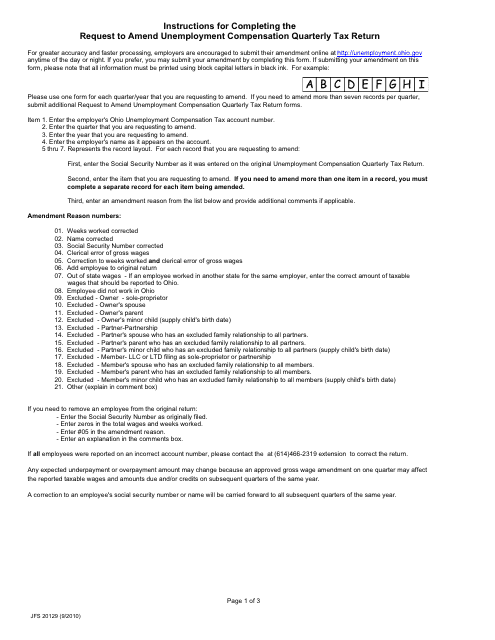

Used by employers to amend an original quarterly tax return. Should you have any questions please call. Is There a Tax.

You may apply for a waiver of these assessments. You can also call the departments individual taxpayer. Due to the Federal American Rescue Plan Act of 2021 signed into law on March.

Ohioans who paid federal andor state income taxes on unemployment benefits they received last year are entitled to a refund. The amount of the refund will vary per person depending on overall. Many people had already filed their.

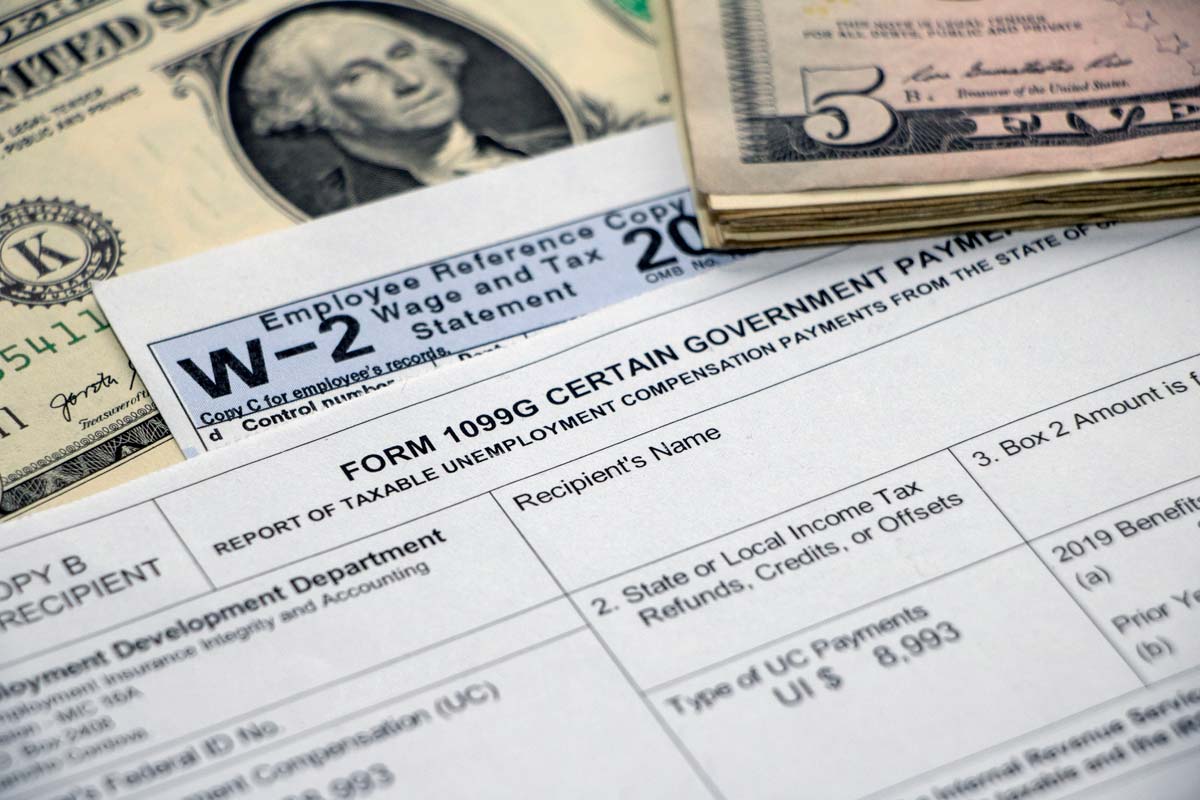

Some states will mail out the 1099G. To amend an original report online please visit. JFS-20129 Request to Amend the Quarterly Tax Return.

The State of Ohio. Government Accountability Office GAO reminded Americans that they may still be. You will have to enter a 1099G that is issued by your state.

File for unemployment benefits online. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. If unemployment benefits are included in federal adjusted gross income AGI they are taxed under Ohio law.

IRS sending unemployment tax refund checks The law that made up to 10200 of jobless income exempt from tax took effect in Mar. 10 hours agoMillions of Low-Income Americans Still Missing Their Stimulus Payments. To obtain the refund status of your 2021 tax return you must enter your social security number your date of birth the type of tax and whether it is an amended return.

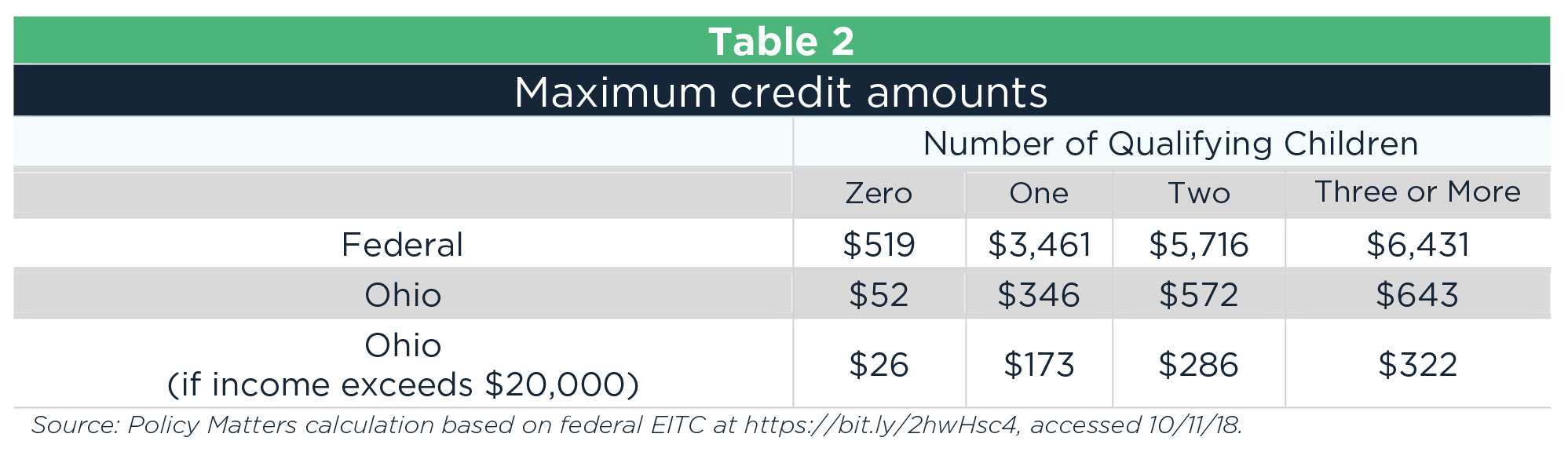

Refundable Tax Credits For Working Families Put Kids First

Will I Owe On Taxes If I Filed Unemployement Wtol Com

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Unemployment Tax Updates To Turbotax And H R Block

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

Download Instructions For Form Jfs20129 Request To Amend Unemployment Compensation Quarterly Tax Return Pdf Templateroller

Is Unemployment Taxable In Ohio Taxation Portal

Can I File A Ssdi Claim While On Unemployment

Rescue Plan Exempts 10 200 In Unemployment Benefits From Taxation

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Rebalance The Income Tax To Build A Better Ohio For Everyone

Cleveland Lags Behind Columbus Cincinnati And Akron In Issuing City Income Tax Refunds Cleveland Com

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Ohio Irs Add Unemployment Tax Exemption From Federal Coivd Relief Bill

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

Ohio Unemployment Benefits Lawsuit Update When Will The Judge Decide On Their Return As Usa